The Succentrix Business Advisors PDFs

The Succentrix Business Advisors PDFs

Blog Article

The Facts About Succentrix Business Advisors Uncovered

Table of ContentsSome Known Facts About Succentrix Business Advisors.Fascination About Succentrix Business AdvisorsSuccentrix Business Advisors - The FactsSuccentrix Business Advisors for DummiesSome Ideas on Succentrix Business Advisors You Should Know

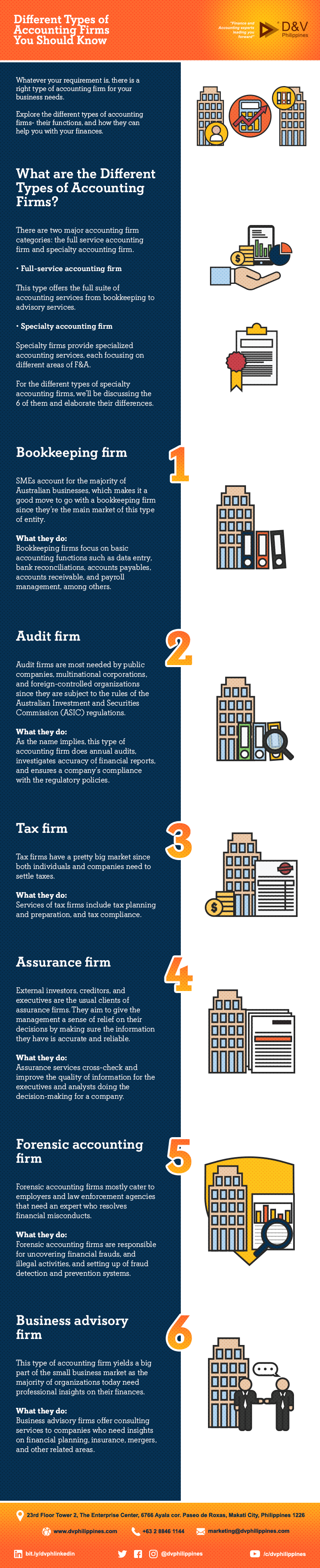

Getty Images/ sturti Contracting out bookkeeping services can release up your time, protect against errors and even minimize your tax costs. Or, perhaps you want to handle your general audit tasks, like accounts receivables, however employ a consultant for money flow projecting.Discover the various types of audit solutions readily available and learn just how to pick the ideal one for your local business needs. Bookkeeping services drop under general or economic accountancy. General accountancy describes routine responsibilities, such as tape-recording deals, whereas financial audit strategies for future growth. You can work with an accountant to get in data and run records or work with a CPA that provides monetary recommendations.

They may additionally fix up financial declarations and document repayments. Prepare and file income tax return, make quarterly tax settlements, file expansions and handle IRS audits. tax advisory services. Small company proprietors additionally assess their tax burden and stay abreast of upcoming modifications to prevent paying greater than essential. Create monetary declarations, consisting of the equilibrium sheet, earnings and loss (P&L), capital, and earnings declarations.

The Main Principles Of Succentrix Business Advisors

-c3tig.png)

Track work hours, calculate wages, hold back taxes, concern checks to workers and ensure accuracy. Audit solutions might additionally consist of making pay-roll tax settlements. Furthermore, you can hire consultants to create and establish your bookkeeping system, provide financial preparation advice and clarify economic declarations. You can outsource primary financial policeman (CFO) solutions, such as succession preparation and oversight of mergers and procurements.

Often, small business owners outsource tax services first and add pay-roll assistance as their firm expands., 68% of participants make use of an outside tax obligation expert or accountant to prepare their firm's taxes.

Create a list of processes and tasks, and highlight those that you agree to contract out. Next, it's time to discover the appropriate bookkeeping company (Professional Accounting and Tax services). Since you have an idea of what kind of audit solutions you require, the concern is, who should you work with to give them? For instance, while a bookkeeper handles information entrance, a CPA can speak on your part to the internal revenue service and offer financial guidance.

Some Known Factual Statements About Succentrix Business Advisors

Before deciding, consider these concerns: Do you desire a neighborhood bookkeeping specialist, or are you comfy working virtually? Does your organization call for market expertise to execute bookkeeping jobs? Should your outsourced services integrate with existing accountancy devices? Do you intend to outsource human sources useful source (HR) and payroll to the exact same supplier? Are you looking for year-round help or end-of-year tax obligation management services? Can a service provider complete the work, or do you need a group of professionals? Do you need a mobile app or online website to manage your accounting services? Carbon monoxide intends to bring you inspiration from leading recognized specialists.

Apply for a Pure Leaf Tea Break Give The Pure Leaf Tea Break Grants Program for little services and 501( c)( 3) nonprofits is now open! Concepts can be new or already underway, can come from HR, C-level, or the frontline- as long as they improve worker wellness through society change.

Something went incorrect. Wait a moment and attempt once again Try once more.

Advisors provide useful insights right into tax strategies, making certain services reduce tax obligation responsibilities while adhering to complex tax obligation regulations. Tax planning entails positive measures to enhance a firm's tax placement, such as deductions, credit histories, and incentives. Staying on top of ever-evolving audit standards and regulatory needs is essential for organizations. Accounting Advisory experts assist in economic reporting, making sure exact and compliant economic declarations.

How Succentrix Business Advisors can Save You Time, Stress, and Money.

Here's a comprehensive consider these necessary abilities: Analytical skills is an essential skill of Bookkeeping Advisory Solutions. You must excel in celebration and examining financial data, drawing meaningful understandings, and making data-driven suggestions. These skills will certainly allow you to analyze monetary performance, recognize patterns, and offer notified assistance to your clients.

Communicating properly to clients is a crucial skill every accounting professional ought to have. You must have the ability to convey complex economic information and understandings to customers and stakeholders in a clear, understandable fashion. This consists of the ability to convert financial jargon right into simple language, produce extensive records, and supply impactful presentations.

Succentrix Business Advisors Things To Know Before You Get This

Accountancy Advisory companies make use of modeling methods to imitate various financial scenarios, evaluate prospective outcomes, and support decision-making. Proficiency in economic modeling is essential for exact forecasting and tactical planning. As a bookkeeping consultatory firm you need to be fluent in economic laws, audit criteria, and tax obligation legislations appropriate to your customers' markets.

Report this page